Key Points

- NAB has been taken to court amid allegations it did not help hundreds of customers in need.

- ASIC claims NAB didn’t respond to 345 hardship applications from customers within the 21-day period required by law.

- The case is scheduled for a hearing in May.

National Australia Bank (NAB) has been sued for allegedly failing to properly answer requests for hardship support from some of its most vulnerable customers over a near-five-year period.

A lawsuit filed by Australian Securities and Investments Commission (ASIC) in the Federal Court claims the bank and one of its subsidiaries did not respond to 345 hardship applications from customers within the 21-day period required by law.

ASIC revealed on Monday it was seeking the court to impose fines on NAB and subsidiary AFSH Nominees.

ASIC chair Joe Longo said the alleged failures could have worsened already difficult situations for some customers.

“We allege NAB unlawfully failed to respond to their customers’ appeal for help when they needed them most,” he said in a statement.

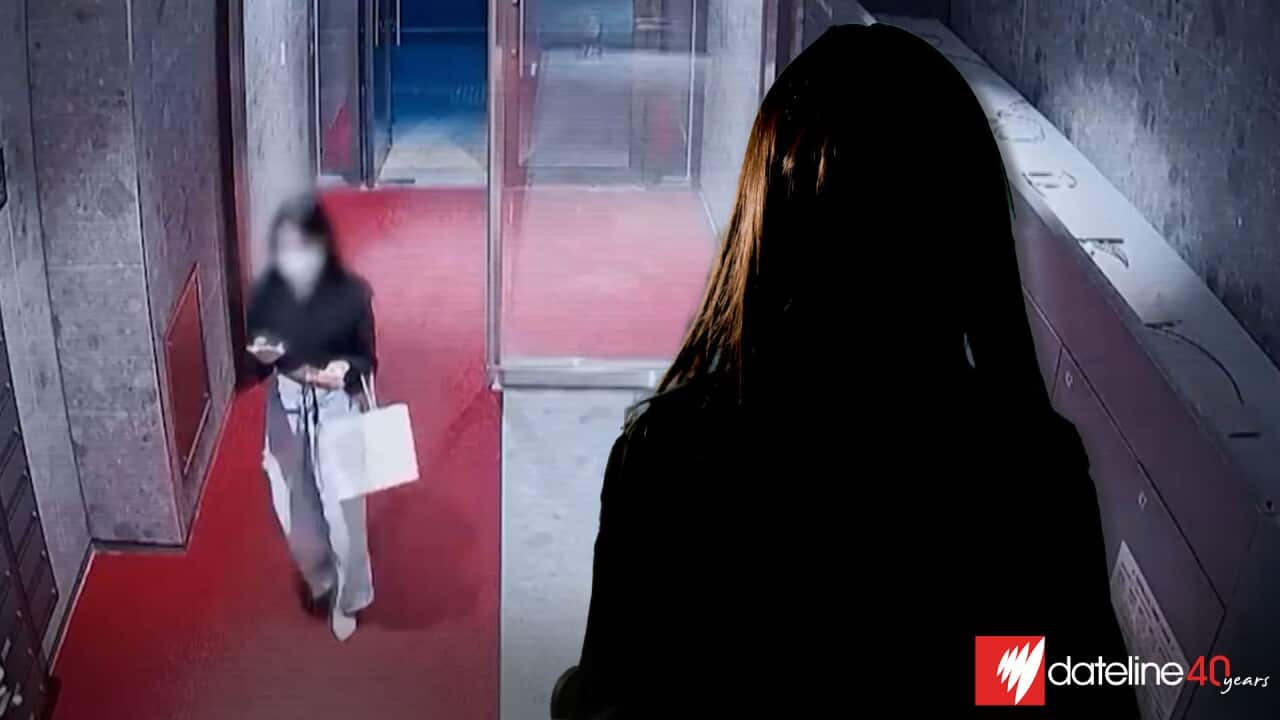

“These customers included people who were domestic violence victims, battling serious medical conditions, dealing with business closures or job loss.

“Amidst rising cost of living pressures, we have seen an increased number of customers reach out to their lenders for relief, and we have seen first-hand the impact on lives and livelihoods when lenders fail to appropriately support customers experiencing financial hardship.”

In a statement to the stock exchange, NAB acknowledged the court action while offering an apology to the affected customers for a period spanning from October 2018 until September 2023.

NAB group executive for customer and corporate services, Sharon Cook, said: “We’re sorry that this happened when a number of our customers were in difficult situations and needed us to be there for them.”

“We are focused on ensuring these customers receive the support they need.”

The bank would cooperate with the regulator and has been working on a revised approach to dealing with customers in financial difficulty, NAB said in its statement.

If a customer notifies a lender that they are unable to meet their credit obligations, lenders, by law, must consider making allowances to vary their contract and advise them of a decision within a specified timeframe.

Longo said ensuring that companies complied with their financial hardship obligations was an enforcement priority for ASIC in 2024.

“We will not hesitate to take decisive action when banks and lenders fail to comply with their obligations,” he said.

ASIC is seeking declarations, pecuniary penalties and adverse publicity orders against NAB and its subsidiary.

, in 2023 for similar alleged breaches involving 229 customers.

The case is scheduled for a hearing in May.